philadelphia wage tax work from home

Anyone who works in Philadelphia and lives in Middletown Township is subject to pay the non-resident Philadelphia Wage Tax which stands at a hefty 34481 as of July 1 2021 of gross. If you dont need to pay the Philadelphia Wage Tax you are subject to the Earned Income Tax.

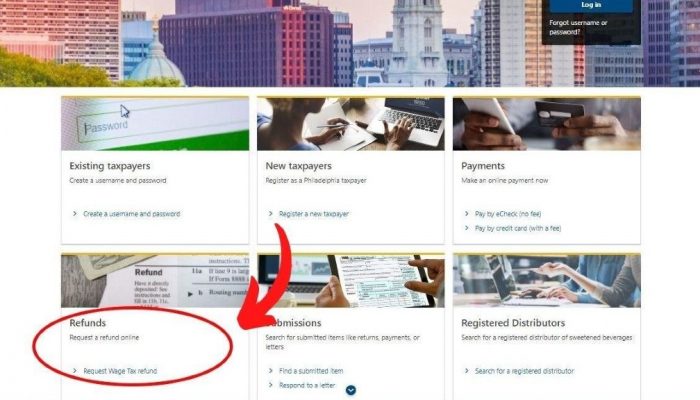

Request 2021 Wage Tax Refunds Online Department Of Revenue City Of Philadelphia

A non-resident employee who works from home for his or her convenience is not exempt from the Wage Tax even with his or her employers authorization.

. In December 2019 a non-resident employee elected to defer 5 of her 2020 compensation. The simple answer is yes. Nonresidents who work in Philadelphia pay a local income tax of 350 which is 043 lower than.

On the other hand if a Philadelphia employer requires a non-resident to perform duties outside the city he or she is exempt from the Wage Tax for the days spent fulfilling that work. Details of the personal income tax rates used in the 2022 Pennsylvania State Calculator are published below. You dont need a username and password to.

Anyone who works in Philadelphia and lives elsewhere must pay the non-resident Philadelphia Wage Tax which is 35019 of gross wages. If companies allow employees to telecommute after pandemic restrictions are. However if a non-resident employee works from home for their convenience even with an employers authorization that employee is not exempt.

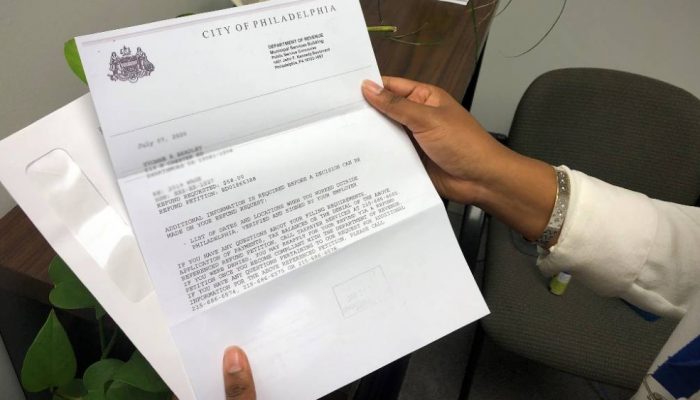

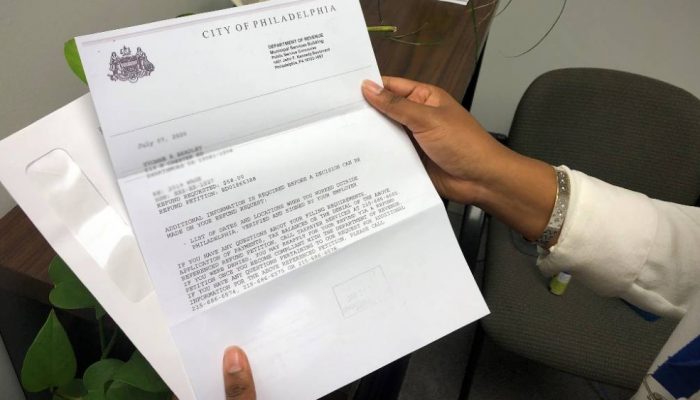

The Philadelphia Department of Revenue is providing 2020 City Wage Tax refunds to non-city residents required to work from home due to the pandemic. This includes all nonresidents refunds. On the other hand if Philadelphia employers require nonresidents to perform duties outside the city they are exempt from the Wage Tax for the days spent fulfilling that work.

Workers can change their tax status and be exempt from the City of Philadelphias City Wage Tax of 34481 until June 30 2020 and 35019 beginning July 1 2020. The wages of the remaining non-resident employees that are not within such categories are subject to Wage Tax only on the days that they report to the Philadelphia work location. Since November allwage tax refund requests can be submitted online at the site above.

In the span of one year this would equal a savings of about 1500. Nonresident Earnings Tax rates will be reduced to 34481 percent down from the previous rate of 35019 percent and resident Earnings Tax rates will be reduced from the previous rate of 38712 percent to 38398 percent effective July 1 2021 according to an announcement by the City of Philadelphia. The refund is allowable only for periods during which a non-resident employee was required to work outside of Philadelphia either pursuant to City ordinance or employer policy.

The wage tax accounts for 45 of Philadelphias annual revenue and is expected to decline by about 78 million this fiscal year despite an increase in the nonresident rate. You must speak to your employer about changing your tax status. If you are an employee of a Philadelphia-based employer and are now required to work remotely from your residence in Lower Providence you should inquire with your employer about withholding the appropriate earned income tax.

In the state of California the new Wage Tax rate is 38398 percent. If you have been and continue to be required to work from home for 90. Further Philadelphia employers may wish to provide a letter on company letterhead to their employees with their W2s confirming the dates employees were required to work from home.

CBS Philadelphia UP NEXT 2. Someone working from home in the suburbs during the pandemic making 60000 per year would be subject to their home municipalitys EIT which is typically 1. Normally Philadelphia non-residents employed in the.

Telecommuters however may no longer be subject to the Philadelphia Wage Tax when they work from home. A non-resident employee required by a Philadelphia employer to work outside of Philadelphia including working from home is not required to pay City Wage Tax for those days spent fulfilling that requirement. That exemption remains in place only if employees are required to work from home.

City Wage Tax is imposed on all the wages for Philadelphia residents whether they work inside or outside of the city and on non-residents when they work in Philadelphia. Nonresidents who work from home for their own convenience rather than the need of the employer are not exempt from the Wage Tax even with their employers authorization. Nonresident employees who had Wage Tax withheld during the time they were required to perform their duties from home outside of the city in 2020 can request a refund through Department by completing a Wage Tax refund petition in 2021.

Philadelphia employers should ensure that their work-from-home policy explicitly indicates that the employees cannot work in the Philadelphia office. Thursday January 28 2021 PHILADELPHIA WPVI -- So many people are working from home during the pandemic and that could impact your taxes. The responsibility for proper tax reporting falls on the individual employee.

Workers will essentially receive a 34481 increase in take-home pay during the time they are working from home. Since July 1 2021 the Philadelphia resident rate is 38398 and the non-resident rate is 34481. The income tax is a flat rate of 307.

Beginning on July 1 2021 the City of Philadelphia will lower the rates of its Wage Tax and Earnings Tax for both resident and non-resident taxpayers alike. The new rates are as follows. Subject to Wage Tax to the extent they are required to work from home.

For those who used to commute to work in Philadelphia there is yet another benefit to working from home besides saving time gas and tolls. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Working from Home May Affect Your Local Wage Tax.

Those FAQs clarified that when workers work from home because of an employer policy that materially limits their ability to come into the office nonresident employees are only subject to Wage Tax. On the other hand if a Philadelphia employer requires a non-resident to perform duties outside the city he or she is exempt from the Wage Tax for the days spent fulfilling that work. Therefore a non-resident who works from home for the sake of convenience is not exempt from the Wage Tax even with his or her employers authorization.

People who live in municipalities with their own earned income taxes may have to begin paying those levies which are usually 1 or less which would still result in a net savings compared with the higher city rate.

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Who Is Entitled To A Wage Tax Refund Department Of Revenue City Of Philadelphia

When Are Non Residents Exempt From Philadelphia S Wage Tax Department Of Revenue City Of Philadelphia

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

Over 42 000 Philadelphians Use New Online Tax System On Top Of Philly News

Philly City Council Reviews Pandemic Impact On Finances Whyy

![]()

Philadelphia Wage Tax Refunds Reboot For 2021

Philadelphia Wage Tax Decreases On July 1 Department Of Revenue City Of Philadelphia

Philadelphians Who Work Outside Pa Could Be Eligible For Wage Tax Break Whyy

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

Philadelphia Looks To Reduce City Wage Tax To Offset Rising Property Tax Burden Philadelphia Business Journal

Pennsylvania Rules On Philly Wage Tax Credit Case Grant Thornton

Philly Wage Tax To Be Lowered In New City Proposal Whyy

Philly Workers Who Stayed Home May Be Due A Wage Tax Refund Newtown Township Bucks County Pennsylvania

Philly Workers Who Stayed Home May Be Due A Wage Tax Refund Newtown Township Bucks County Pennsylvania

Philly Wage Tax To Be Lowered In New City Proposal Whyy

/cloudfront-us-east-1.images.arcpublishing.com/pmn/MASTJCL4ZJBBDONJ5JKW7DLG3I.jpg)

Philly S Ability To Generate Job Growth Could Mean The Difference Between Renaissance Or Stagnation

File Philadelphia Wage Tax Return Quarterly In 2022 Wouch Maloney Cpas Business Advisors